seattle payroll tax vote

On April 15 the City of Seattle. Businesses with at least 7 million in annual payroll will be taxed 07 to 24 on salaries and wages spent on Seattle employees who make at least 150000 per year with.

Seattle City Council Approves Payroll Tax On Largest Best Paying Companies Fox Business

Thursday June 23 2022.

. JumpStart Seattle taxes employers with payrolls of at least 7 million on employees making at least 150000 per year. This week the Washington Court of Appeals affirmed a lower courts decision to dismiss a challenge to the recently enacted payroll expense tax in. SEATTLE WA Seattle City Council has passed a progressive payroll tax on the citys largest businesses with a vote of 7 - 2.

The measure passed 7-2. While the ordinance has not yet been signed by the mayor as. This tax targets big earners and the companies.

City Council passes payroll tax. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. The payroll tax was sold as a way to replenish Seattles emergency management fund that was used up in response to the COVID-19 pandemic.

The Seattle City Council on Monday voted 7-2 to to approve a measure that would add a payroll tax for companies in the city that have the largest payrolls. That margin makes it veto-proof an important. On 07062020 Kevin Schofield In tax.

This afternoon the City Council passed by a 7-2 vote the much-touted Jump Start Seattle payroll. For example in 2021 businesses that had 7 million or. The legislation calls for a tax of 275 per employee per year on for-profit companies that gross at least 20 million per year in the city down from a 500-per-head.

SEATTLE The Seattle City Council voted Monday to impose a new payroll tax on big businesses. The Seattle City Council is poised to pass a payroll expense tax package to fund Covid-19 relief and affordable housing at its 2pm meeting today. Under the measure businesses with at least 7 million in annual payroll expenses will be taxed 07 to 24 on the amount they pay Seattle-based employees with tiers based.

The Seattle payroll tax colloquially known as the JumpStart Seattle tax collected more than 231 million for 2021 exceeding the citys early estimates by more than 15. However businesses must use the current years compensation paid in Seattle to determine the payroll expense tax due for the year. 1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or more but less than 100 million.

The move which went into effect Jan. Its a tiered tax plan with rates starting at 07.

Seattle Council Votes To Repeal Tax To Help Homeless Amid Opposition From Amazon Other Businesses The Washington Post

Seattle City Council Approves New Payroll Tax Plan Komo

Opinion Tax Foundation Seattle Times Highlight Capital Gains Income Tax Advisory Vote Clarkcountytoday Com

Who Voted For Sawant Map Compared To A Map Of Income Distribution In Seattle R Seattle

Debate Starts This Week On Sawant S Head Tax 2 0 Puget Sound Business Journal

Wash Voters Once Passed An Income Tax By A Wider Margin Than Vote For Legal Booze Knkx Public Radio

Seattle For Dan Strauss Seattle4strauss Twitter

Seattle Passes Payroll Tax Targeting Amazon And Other Big Businesses

How Seattle S New Payroll Tax Complicates Efforts To Enact One Statewide Crosscut

Seattle City Council Passes Jumpstart Tax On High Salaries Paid By Big Businesses The Seattle Times

Seattle City Council Set To Vote On High Earner Income Tax King5 Com

Seattle Income Tax Set For City Council Vote Following Committee Approval Geekwire

Seattle City Council Votes High Earner Income Tax Court Challenge Certain

Proponents Of Tax Increase On Income Over 1m Launch First Tv Ad Boston Business Journal

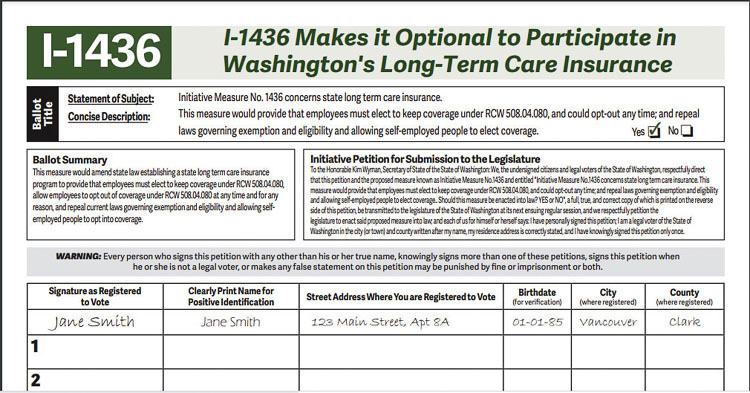

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program Clarkcountytoday Com

Seattle City Council Approves New Payroll Tax Plan Komo

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute